Unlocking The Secrets Of Wyandot County Property: A Comprehensive Guide To The Tax Map

Unlocking the Secrets of Wyandot County Property: A Comprehensive Guide to the Tax Map

Related Articles: Unlocking the Secrets of Wyandot County Property: A Comprehensive Guide to the Tax Map

Introduction

With great pleasure, we will explore the intriguing topic related to Unlocking the Secrets of Wyandot County Property: A Comprehensive Guide to the Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unlocking the Secrets of Wyandot County Property: A Comprehensive Guide to the Tax Map

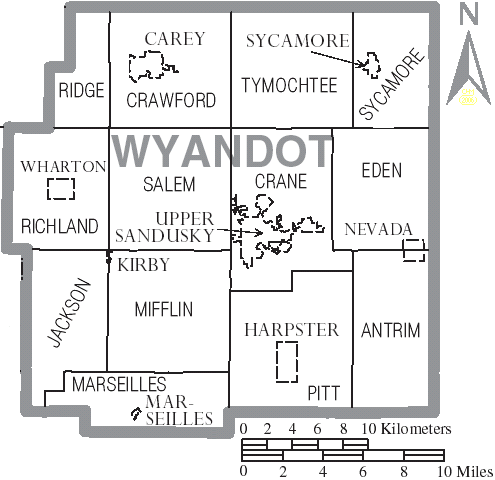

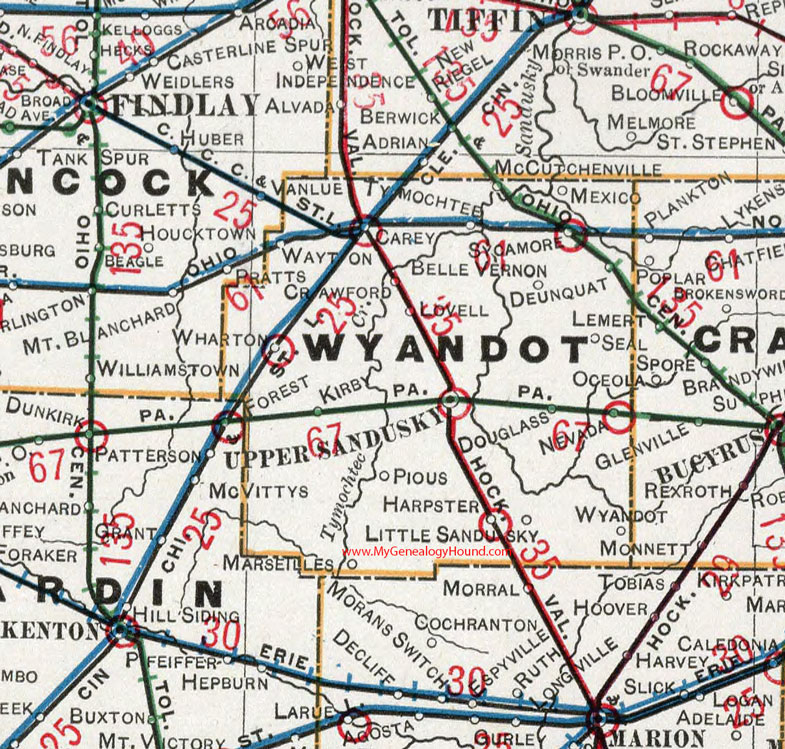

The Wyandot County Tax Map serves as a vital tool for understanding and navigating the county’s real estate landscape. This detailed map, meticulously maintained by the Wyandot County Auditor’s Office, provides a comprehensive overview of property ownership, boundaries, and valuations, offering invaluable insights for both residents and professionals.

Understanding the Wyandot County Tax Map

The Wyandot County Tax Map is not simply a visual representation of property lines; it is a complex and intricate data repository. Each parcel of land within the county is assigned a unique identifier, allowing for precise location and identification. This map is instrumental in:

- Property Assessment: The map serves as the foundation for determining the fair market value of properties within the county. This information is crucial for calculating property taxes, which are a major source of revenue for local government services.

- Property Ownership: The map clearly delineates property ownership, providing information on the legal owner of each parcel. This is essential for real estate transactions, land records, and legal proceedings.

- Planning and Development: The map assists in understanding the existing land use patterns, zoning regulations, and potential development opportunities within the county. It plays a critical role in guiding urban planning, infrastructure development, and environmental protection efforts.

- Emergency Response: The map aids in identifying property locations, access points, and potential hazards during emergency situations, facilitating efficient response and coordination by emergency services.

Navigating the Wyandot County Tax Map

The Wyandot County Tax Map is accessible through various channels, ensuring convenient access for all stakeholders.

- Online Access: The Wyandot County Auditor’s website offers a user-friendly interface to browse the tax map, allowing users to search by address, parcel number, or owner name. This online platform provides interactive features, enabling users to zoom, pan, and access detailed information about each property.

- Physical Copies: Hard copies of the tax map are available at the Wyandot County Auditor’s Office for those who prefer a tangible resource.

- GIS Data: The map data is also available in Geographic Information System (GIS) format, providing a powerful tool for professionals who require advanced spatial analysis capabilities.

Interpreting the Wyandot County Tax Map

The Wyandot County Tax Map employs standardized symbols and conventions to represent various features, ensuring clarity and consistency. Understanding these symbols is crucial for accurately interpreting the map’s information:

- Parcel Boundaries: Lines on the map represent the legal boundaries of individual properties.

- Parcel Numbers: Each parcel is assigned a unique identification number, facilitating easy referencing and retrieval of property information.

- Property Ownership: The map may indicate the name of the property owner or a reference to the legal documentation.

- Land Use: Symbols or colors may be used to denote the primary use of the land, such as residential, commercial, agricultural, or industrial.

- Zoning: The map may indicate zoning classifications, providing insights into permitted land uses and development regulations.

- Topographical Features: The map may incorporate elements like elevation, rivers, roads, and other natural features, providing context and enhancing understanding of the terrain.

Benefits of the Wyandot County Tax Map

The Wyandot County Tax Map offers numerous benefits to various stakeholders:

- Property Owners: The map provides clear and accurate information about their property, enabling them to understand their property boundaries, assess its value, and navigate potential transactions.

- Real Estate Professionals: The map is a valuable tool for real estate agents, appraisers, and developers, providing comprehensive data for property valuations, market analysis, and development planning.

- Government Agencies: The map assists county officials in managing property records, enforcing zoning regulations, and planning for future growth and development.

- Businesses: The map helps businesses identify suitable locations for operations, understand the surrounding land use, and make informed decisions about property acquisition or leasing.

- Residents: The map provides residents with valuable information about their neighborhood, including property boundaries, zoning regulations, and potential development projects.

Frequently Asked Questions (FAQs) about the Wyandot County Tax Map

Q: How can I find my property on the Wyandot County Tax Map?

A: You can access the tax map online through the Wyandot County Auditor’s website. You can search by address, parcel number, or owner name.

Q: What information is available on the tax map for each property?

A: The tax map provides information about the property’s boundaries, parcel number, ownership, land use, zoning classification, and assessed value.

Q: How can I obtain a physical copy of the Wyandot County Tax Map?

A: You can obtain a physical copy of the tax map from the Wyandot County Auditor’s Office.

Q: How often is the Wyandot County Tax Map updated?

A: The tax map is updated regularly to reflect changes in property ownership, land use, and other relevant factors.

Q: What are the legal ramifications of using the Wyandot County Tax Map for boundary disputes?

A: The tax map is a valuable tool for understanding property boundaries, but it is not a legal document. For legal disputes, it is essential to consult with a qualified surveyor or legal professional.

Q: Can I use the Wyandot County Tax Map to determine the value of my property?

A: The tax map provides the assessed value, which is not necessarily the same as the market value. To determine the market value of your property, it is recommended to consult with a licensed real estate appraiser.

Tips for Using the Wyandot County Tax Map

- Familiarize Yourself with the Symbols: Take the time to understand the symbols and conventions used on the map to ensure accurate interpretation.

- Utilize the Search Functions: Leverage the online search functions to quickly and efficiently locate specific properties.

- Verify Information: Always double-check information obtained from the tax map with official records and legal documentation.

- Consult with Professionals: For legal or technical questions related to property boundaries, zoning, or valuations, seek professional guidance from surveyors, attorneys, or real estate appraisers.

Conclusion

The Wyandot County Tax Map serves as a valuable resource for understanding and navigating the county’s real estate landscape. It provides a comprehensive overview of property ownership, boundaries, and valuations, offering insights for residents, professionals, and government agencies alike. By leveraging the information contained within this map, stakeholders can make informed decisions related to property transactions, development projects, and land management, contributing to a thriving and well-informed community.

Closure

Thus, we hope this article has provided valuable insights into Unlocking the Secrets of Wyandot County Property: A Comprehensive Guide to the Tax Map. We hope you find this article informative and beneficial. See you in our next article!

You may also like

Recent Posts

- Unraveling The Mystery: Exploring The Bermuda Triangle Through Google Maps

- The Intricate Web Of Territory: Exploring The Map Of The Warrior Cats

- Navigating The Landscape Of Gaming: A Comprehensive Guide To Casinos In New York State

- Unraveling The Secrets Of The Barren River Lake: A Comprehensive Guide

- The Ever-Evolving Landscape Of 2b2t: A Look At The 2021 Map

- Navigating The Terrain Of Conflict: Understanding The Map Of Vietnam During The War

- Unveiling The Tapestry Of Fresno: A Comprehensive Guide To The City’s Geographic Landscape

- Unveiling The Tapestry Of Medieval Spain: A Journey Through Maps

Leave a Reply